LEADING THE WAY FOR 20 YEARS

celebrating our 20th year as a leader in default claims management

December 2022 marks our 20th year in the post-default segment of the residential mortgage servicing industry. Since our founding in 2002, CRFS has grown to become the recognized leader in post-default claims management outsource and consulting solutions.

We accomplished that through a proven process, filing thousands of claims per month and recovering hundreds of millions of dollars on average per year. We’re committed to building strong client relationships by consistently delivering quality workmanship and fast, efficient service.

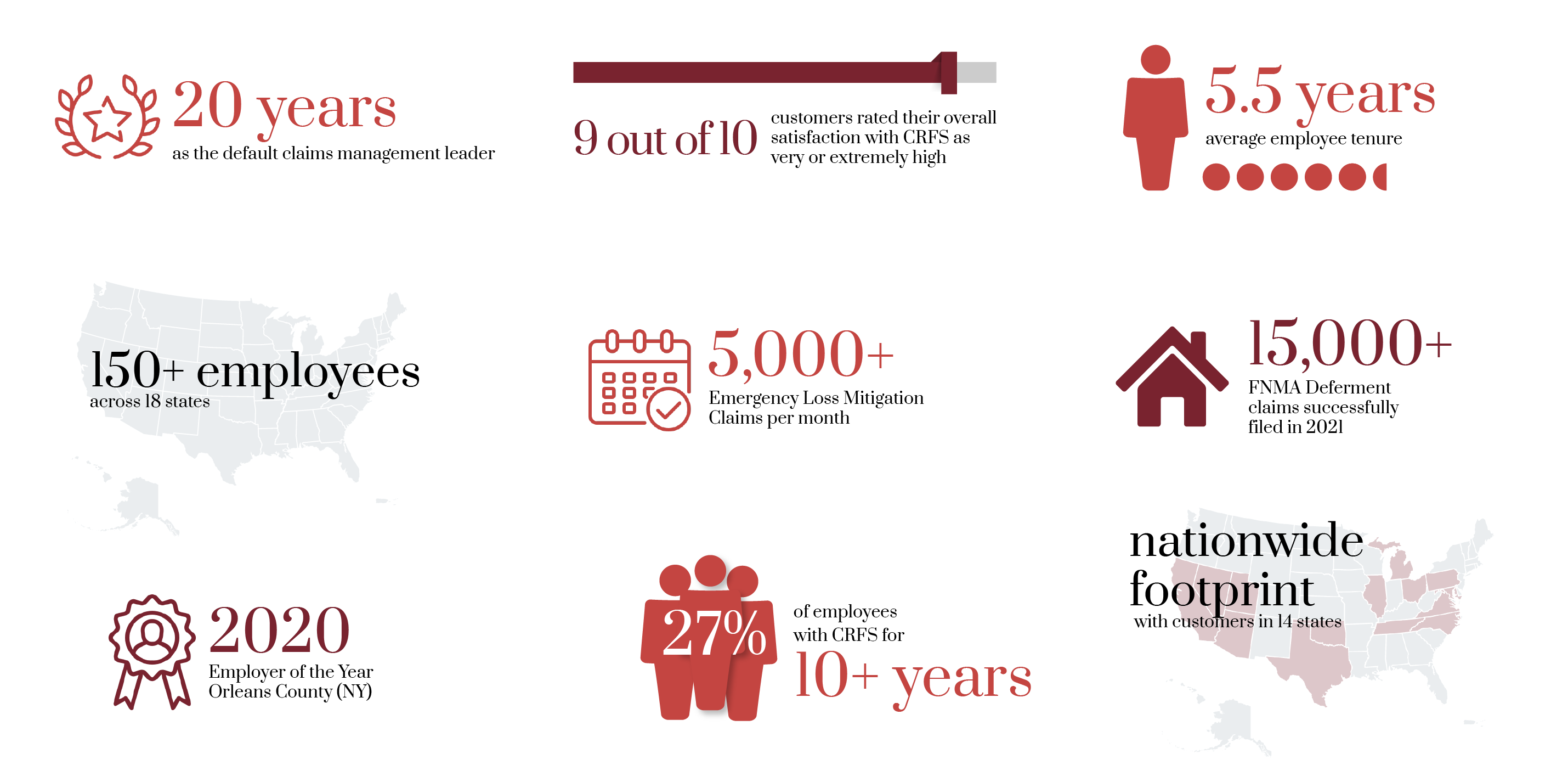

Our clients and partners have come to expect the very best from the CRFS team, and 9 out of 10 of our clients rate their overall satisfaction with us as Very or Extremely High. And we won’t stop until we achieve 10 out of 10.

Our primary focus remains being a strategic partner, dedicated to providing unmatched timeliness, exceptional customer service, and measurable results.

CRFS by the numbers

the industry’s most experienced workforce

Our 20-year success story wouldn’t be possible without a workforce that is among the industry’s most experienced and talented. In an effort to attract the brightest and best in our industry from all across the country, CRFS established a national recruiting model and remote-friendly work environment in 2019. Today, our more than 150 employees hail from 18 different states and provide our clients with a vast range of specialized expertise and local knowledge.

At the same time, CRFS continues to maintain deep roots in Western New York and was named “Employer of the Year” for 2020 by the Orleans County (NY) Chamber of Commerce.

Even as we continue to grow our team, the average tenure of CRFS employees is 5.5 years, with more than a quarter of our workforce having been with us for 10+ years.

“The value proposition to our clients is pretty straightforward – we reduce risk while improving financial outcomes.”

Steven Mowers

CRFS PRESIDENT

growing to meet the changes and challenges of today

As we’ve expanded through the years, we’ve also enhanced our capabilities, including establishing a dedicated Compliance team. This group closely monitors and assesses regulatory updates that impact investor and insurer timeframes, guidelines, client recoverability, potential audit risks, and default timelines. We also provide meaningful ongoing compliance updates to investors, insurers, clients, and industry partners.

During 2020 and 2021, mortgage forbearance and foreclosure rules instituted by the federal government in response to the global pandemic reduced traditional default and foreclosure claim volumes to historically low levels and introduced new claim types to provide relief to borrowers impacted by the pandemic.

In response to the challenges brought by the pandemic and to ensure continued development of innovative strategies, in 2021 CRFS established a new Office of Innovation. Part of our 20-year history has been our ability to successfully adapt to and manage changes in our industry now and in the future.

To help our clients adapt to these changes, CRFS developed and rolled out new products, such as the FHA Emergency Loss Mitigation claim. Over a period of five weeks, we invested in technology upgrades – including integration with the FHA Catalyst system – and built out our workforce to greatly expand our Loss Mitigation processing capacity. In total, we expanded our processing and QC operations to handle more than 5,000 Emergency Loss Mitigation claims per month – a five-fold increase in capacity.

During 2021 CRFS launched an equivalent product in support of FNMA Deferment claims, and by the end of the year had successfully filed over 15,000 of these claims for our clients. In early 2022, CRFS launched its VA Partial Claim solution to support clients facing significant volumes of this new claim type. CRFS’ Office of Innovation, in partnership with a third-party technology vendor, finalized and rolled-out an enhanced Claims Management platform that included functionality for the VA Partial Claim. Within the first two months of implementation, CRFS submitted over 200 VA Partial claims with an average recovery per claim several times higher than the cost, and total production capacity is currently 400 claims per month.

looking to the future

Our 20th anniversary is a time to reflect on all we’ve accomplished for our clients and our employees. But at CRFS, we’ll never be content to rest on our laurels.

We continue to respond to the rapidly changing mortgage industry and the growing needs of our clients with innovative products and services, an outstanding team of experienced professionals, and our continued dedication to delivering the highest quality work on time – every time.