AVOID LOSS BEFORE IT HAPPENS

Get actionable data before loss occurs with the Default Timeline Manager

More than ever, FHA mortgage servicers are experiencing reduced financial recoveries from avoidable errors that occur prior to the claims process. These delays occur throughout the default lifecycle – from early delinquency all the way to the foreclosure process – in the form of missed compliance milestones which could be from untimely oversight, inaccurate data, incorrect processes and automation or any combination of the three.

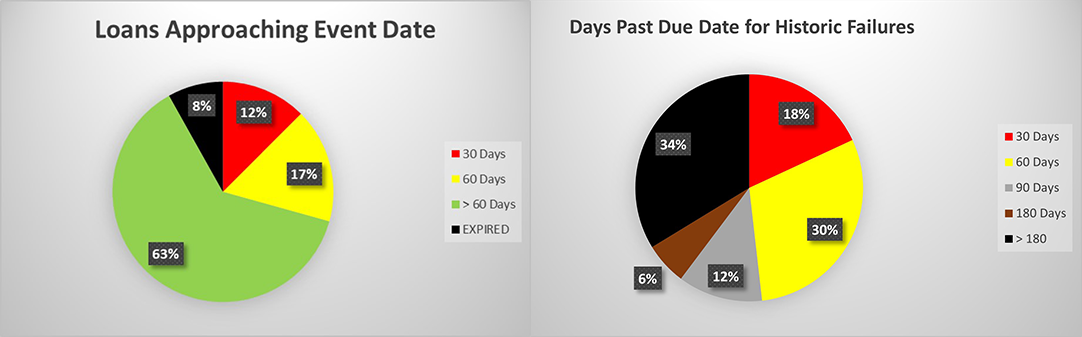

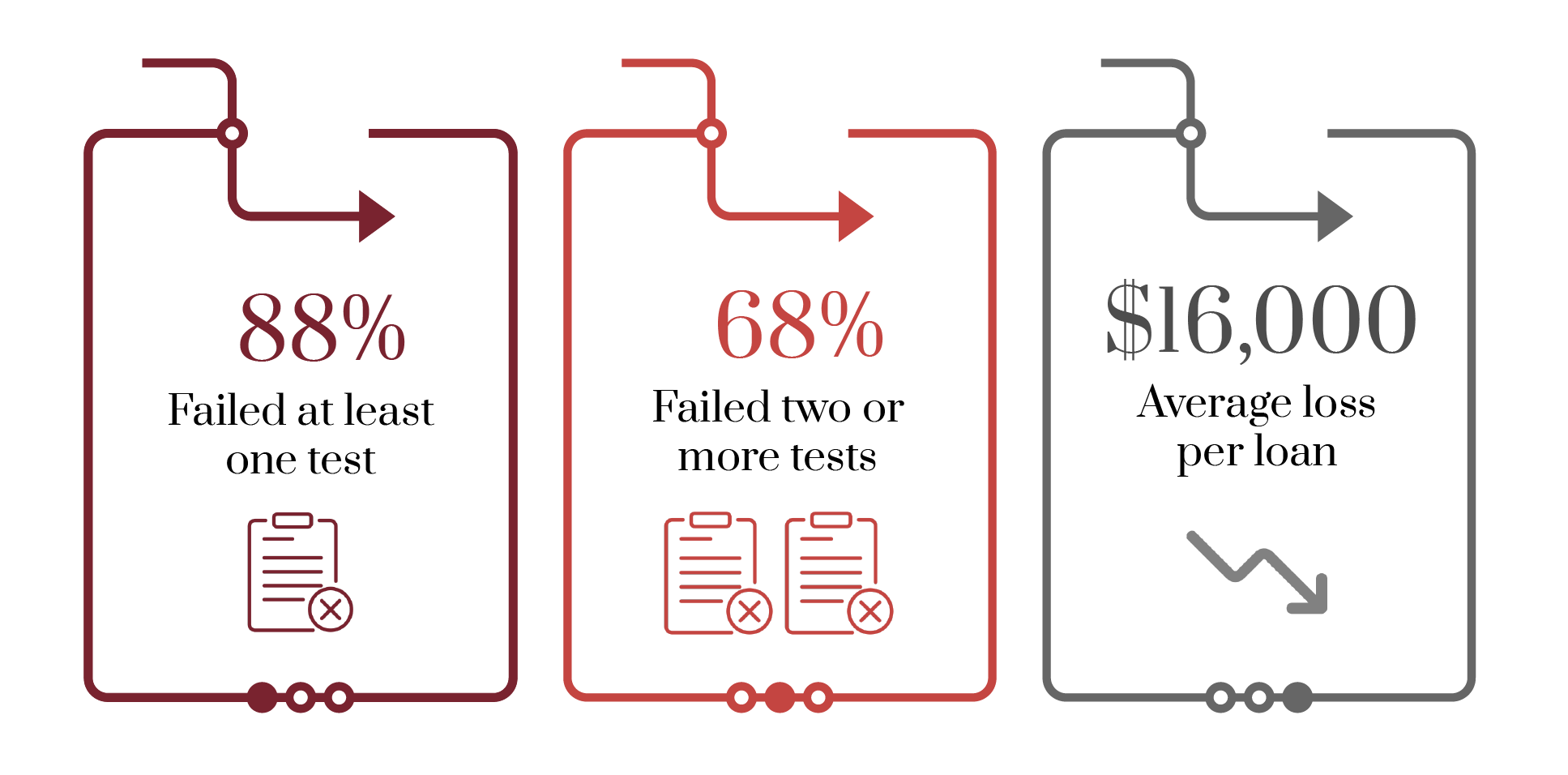

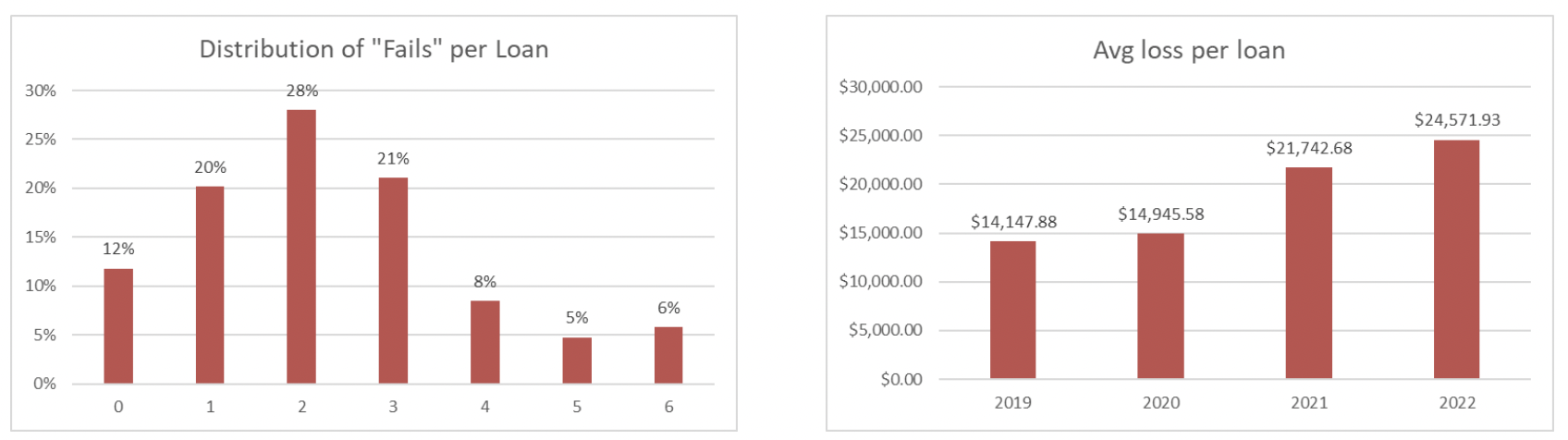

Findings from an internal study

CRFS observed that while the loan runs the gauntlet of timeline tests through the default process, 88% of all FHA loans have suffered a curtailment loss by failing at least one test, and 68% have failed two or more tests. These failures impact the servicer with curtailments primarily in the areas of interest and preservation costs. The average loss per loan over the past 4 years is $16,000 or 9% of unpaid principal, with the more recent years being $25,000 or 15% of unpaid principal.

Of all FHA loans that suffered a curtailment loss:

* Based on an internal, multi-year review of over 7,500 claims from CRFS servicing base.

Alleviate regularly occurring delays

Building a reliable, repeatable “smart” process that commences at Default Day 60 and provides real-time analytics and comprehensive reporting at the FHA loan and portfolio levels through the life of default will help mitigate the avoidable delays which occur on a regular basis.

The ability to obtain actionable reporting that focuses on managing accurate, forward due dates (e.g., First Legal Deadline) at the FHA loan or portfolio level will provide servicers the opportunity to take the necessary steps to avoid curtailments, request extensions, and ultimately reduce losses by increasing recoveries.

CRFS Default Timeline Manager

At an agreed-upon delinquency milestone (e.g., the 60 Day Delinquent mark), the loan file is automatically referred to the Default Timeline Manager which begins building the monitoring and reporting framework for:

• Payment History Review

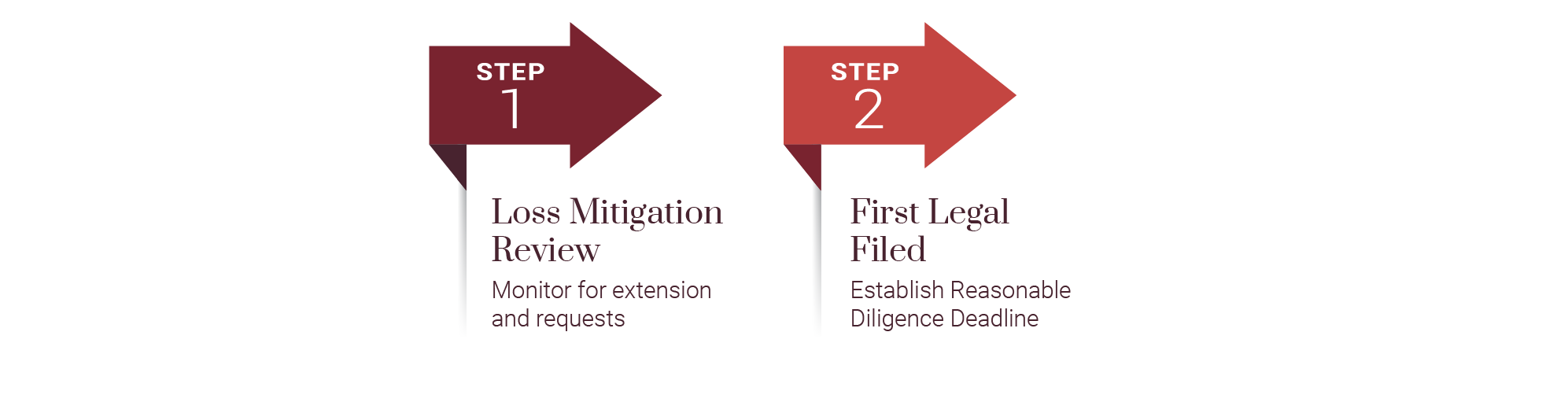

• Loss Mitigation Review

• First Legal Deadline Determination

• Verification of Occupancy

• Active Bankruptcy Review

The Default Timeline Manager then provides Continuous Default Timeline Monitoring and automated recurring reporting on performance metrics against key milestones and deliverables including:

As the loan file progresses through the Delinquency Lifecycle, the Default Timeline Manager then provides actionable notifications and alerts against critical milestones and deliverables in the delinquency process including:

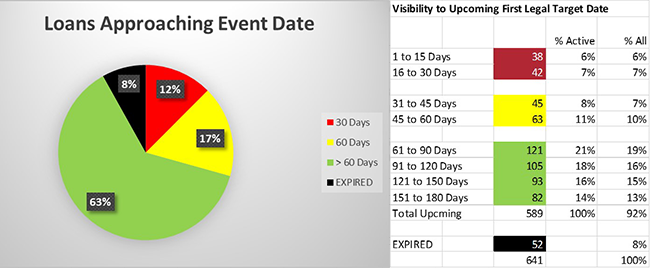

Example of Reporting Output for the First Legal Deadline metric

Find out more

"*" indicates required fields